Dr Christof Engelskirchen, chief economist at the Autovista Group, reviews the data and facts around the remarketing of battery-electric vehicles (BEVs) and assesses whether related fears are justified.

Battery-electric vehicles (BEVs) are enjoying popularity at the moment with demand outstripping supply. This is no surprise as national and regional policies on sustainability clearly point to BEVs being the future for at least next 20 years. Furthermore, strongly government-incentivised BEVs are very competitive from a total cost of ownership-perspective and they are fun to drive.

However, there is a disconnect between new- and used-car markets – almost none of the advantages that new-BEV owners benefit from exist for used-BEV owners. This has translated into anxiety about the remarketing risks for BEVs, the majority of them being in a leasing/ PCP-type arrangement.

Minimising the effects of aging

The first used cars that hit the market after the launch of a new vehicle often create very strong remarketing results – a honeymoon effect. However, cars do not only lose value as their mileage and years on the road increase, they also age over the model’s lifecycle. Consequently, a three-year-old used vehicle that is hitting the used-car market for the first time will cost more than a three-year-old used vehicle that has been available for five years or longer as a used car.

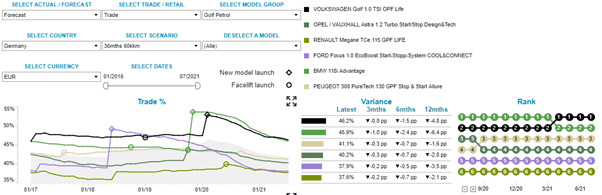

The chart below shows this effect: when the new BMW 1-series (marked with the rhombus at the top green line) hit the market in 2019, it yielded a strong 10%-points uplift in used-car values. Following this launch effect, the line begins to decline swiftly. It is still ahead of its predecessor, but is closing in. It then crosses the Golf’s RV performance line (black line).

Residual value development for selected C-segment competitors in Germany, forecasts, Jan 2017 – Jul 2021

Source: Autovista Group Residual Value Monitor

In contrast, the Volkswagen (VW) Golf (black line) is known for ‘aging well’ and being particularly ‘timeless’ as a model, and this translates into comparatively smaller lifecycle effects. The Golf evolution is stable over time and the launch effect has been smaller (5.5 percentage points). The Ford Focus (purple line), on the other hand, shows a 10 percentage-point launch effect and features a very pronounced lifecycle depreciation.

Commercially, it is always better to minimise lifecycle depreciation than maximise launch effects, as stronger residual values (RVs) over the entire lifecycle require less subsidies and discounts on new-car markets for the model to sell. Those OEMs that are able to deliver a more favourable lifecycle depreciation pattern for their models dip into a combination of the following from their toolbox:

- No or low discounts;

- Less aggressive channel mix than the market average

- Timeless model design

- Effective lifecycle management via equipment

- Packaging; and

- Special editions of a strong brand

BEVs age faster than ICE

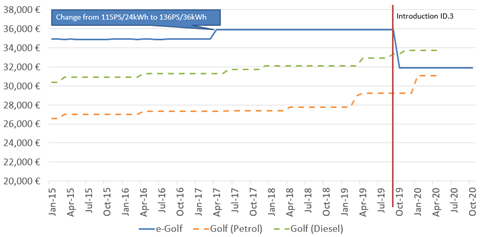

Almost any brand could have been selected to contrast BEV models – the list price evolution below features various Golf models over time. During 2017, the e-Golf received a powertrain/ battery update, and prices rose slightly. In September 2019, VW cut prices for the e-Golf in anticipation of the more advanced ID.3.

List price development e-Golf, Golf petrol, Golf diesel between Jan 2015 and May 2020, Germany

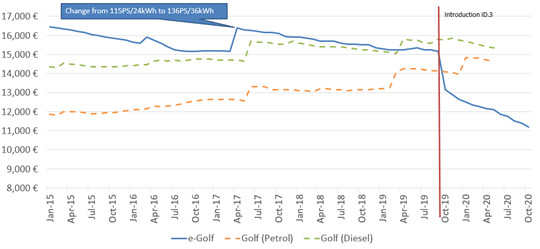

The effects on the lifecycle depreciation pattern of the e-Golf compared to its internal-combustion engine (ICE) variants are evident (see chart below): the battery upgrade in 2017, which represents a powerful move in lifecycle management for a BEV, increased RVs. Irrespectively, and sticking to the left side of the red vertical line, lifecycle depreciation is higher for the e-Golf than for the two ICE Golf-variants. This is largely due to competitors launching BEV models with better ranges.

The price cut with the introduction of the ID.3 (marked with the red vertical line) initiated a further substantial decline in RVs for the e-Golf. Arguably, the latter is a unique effect but it does show how sensitive used-car prices for BEVs are to advances in technology, in particular of range, and competitive action, in this case from the designated successor within the own company.

Residual value development (forecast/ 36m/60tkm/ trade) e-Golf, Golf petrol, Golf diesel between Jan 2015 and May 2020, Germany

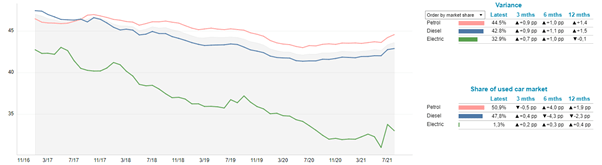

BEVs perform below ICE competitors in %-RVs

When considering some of the main passenger-car segments (B/B-SUV, C/C-SUV, D/D-SUV) in the chart below, referencing again Germany, the more pronounced lifecycle effects of BEV technology are again confirmed. The green line, which represents the weighed RV performance of all BEVs, falls more steeply than petrol or diesel. Some of the more recent decline links to the substantial government discounts offered on new-car markets for BEVs: €9,000 for a new BEV, representing a quarter of the list price in some segments. The green line for the BEV is more volatile, reflecting the frequent change of mix in the market. In the table to the right, only 1.3% of used-car transactions represent BEVs, when expressing their share in relation to the total of petrol, diesel, and BEV.

Residual value development, in % of list price, Germany, for B/B-SUV, C/C-SUV, D/D-SUV segments, weighted, 36m/60tkm

BEVs currently perform at the same level as petrol cars when looking at the absolute RV performance in EUR (not shown), despite the still significant list price differences.

Those that are anxious about RV formation for BEVs over the coming years have a point but should not panic. There are a number of actions and market aspects to consider:

- Current used-car values for BEVs are already at a low point and reflect the high discounts offered in many markets and the anticipated technological advancements. It is unlikely that discounts will rise. They will therefore not add additional pressure.

- It is likely that lifecycle depreciation will continue to be stronger for BEVs than for ICE over the coming years, as long as range improves with new model generations. It is simple to reflect that factor in RV setting for a model as it ages. It will have to be based on investigating a model’s and brand’s competitive performance.

- Our experts expect slightly more RV pressure for BEVs over the coming years than for ICE due to an oversupply of used BEVs, in particular in the high-subsidies markets. Equally, ICE residual values will likely benefit due to a supply shortage as new-car markets shift to electric.

- To minimise RV risks for the BEV (and to maximise remarketing opportunities for the ICE), a highly professional cross-border approach to remarketing will be highly beneficial.

- Any advancements with regard to assurance of battery quality via a battery certificate, and continued extended warranties for batteries of used BEVs will support RV formation for the used BEV.

- Transparency around the cost to repair or to replace the battery and proceeds from a sale of the battery into its second life would support RVs for BEVs as well.

- Overall, the more diversified portfolio of leasing companies will add financial value as well.

For more exploration of this topic, join the Autovista24 webinar on ‘The EV-Subsidies Gamble – Impact on new- and used-car markets’ on 22 September.

Close

Close