Bigger batteries may remedy range anxiety, but smaller power-storage units can reduce costs and purchase prices of battery-electric vehicles (BEVs). Dr Christof Engelskirchen, chief economist of Autovista Group (part of J.D. Power), explores the economies of smaller batteries.

As the BEV market develops, with carmakers introducing new models, not all brands offer a variety of battery-size options. This is a valid approach, as focusing on larger power-storage units helps to tackle both range anxiety and charging anxiety.

This means peace of mind and conveys an impression of being future-proof. This is especially true as charging infrastructure continues to develop across Europe, where it currently may struggle to meet demand.

Few will question the logic of choosing a larger battery, while selecting a smaller one may raise some eyebrows. But is it rational to opt for the biggest battery unit available, especially as it is the most expensive BEV component? The short answer is ‘it depends’.

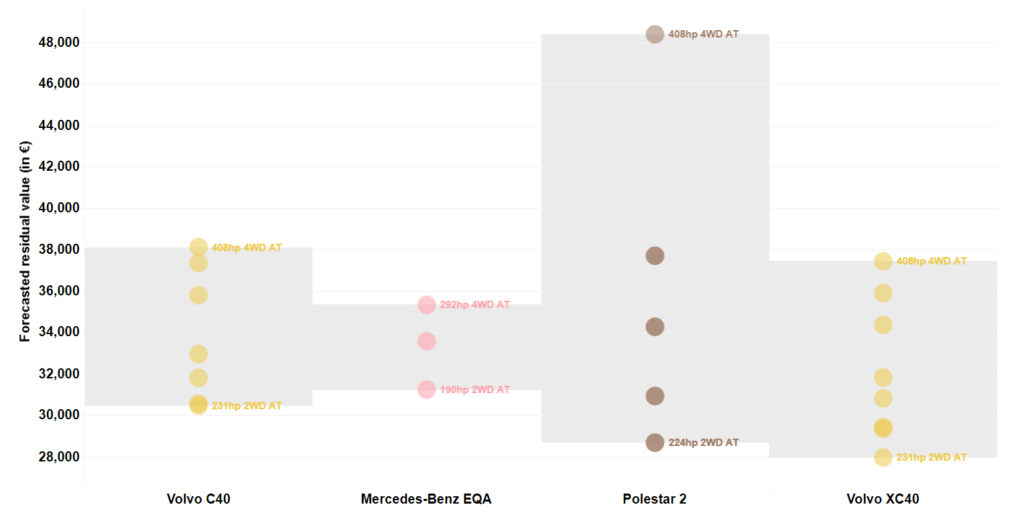

To understand whether bigger really is better, some facts need to be unpacked. This can be achieved by comparing the standard and the long-range variants of the Tesla Model Y and Volvo EX30, with a focus on the rear-wheel drive (RWD) single-motor variants.

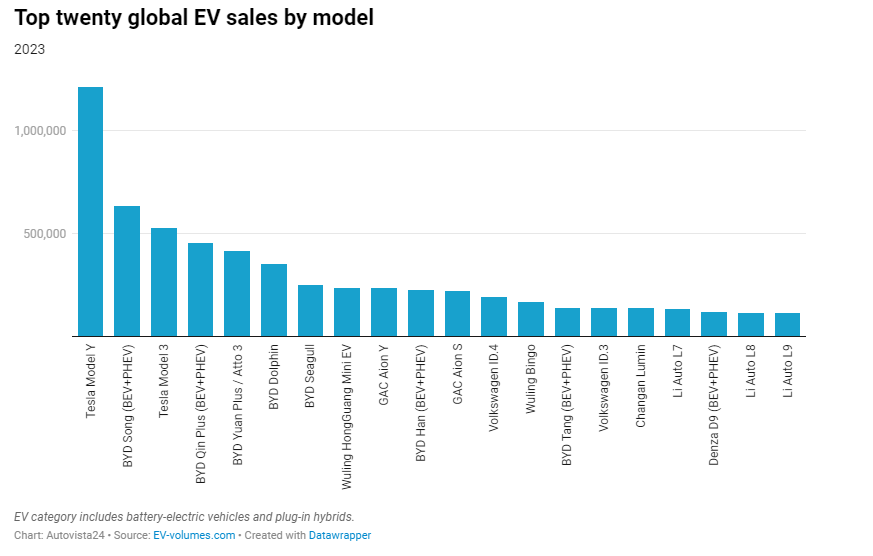

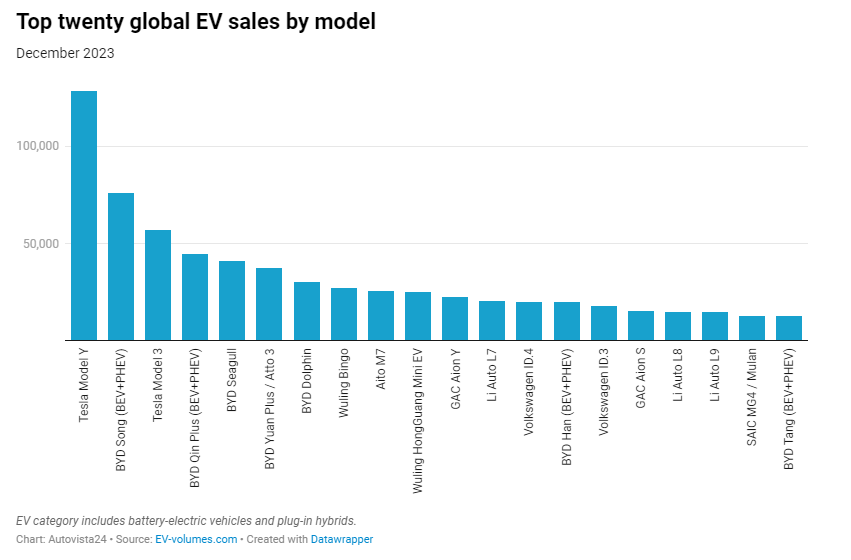

The Model Y was not only the best-selling car in Europe last year, but it also took the global title. Meanwhile, the recently introduced EX30 emphasises mass-market compatibility, in a vehicle segment where this has been absent for so long.

The cost of greater range

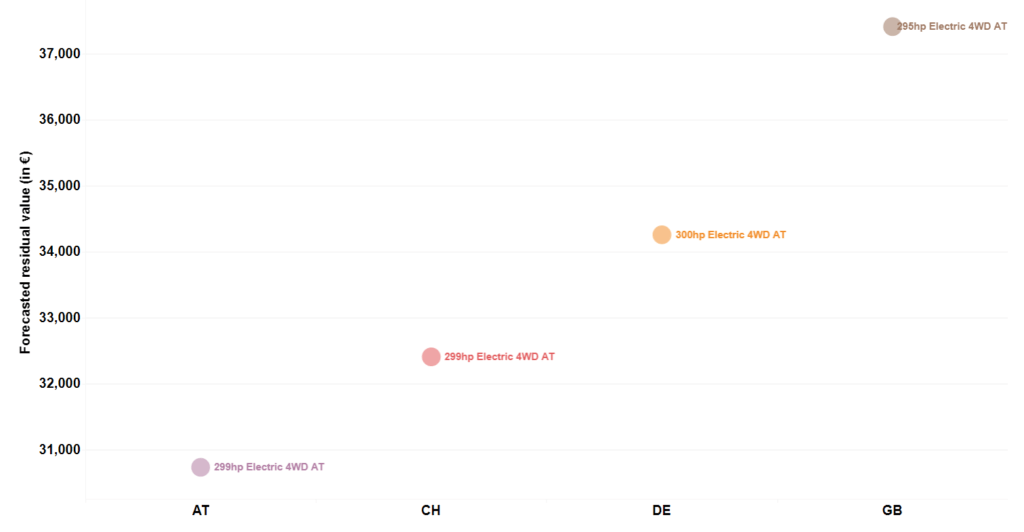

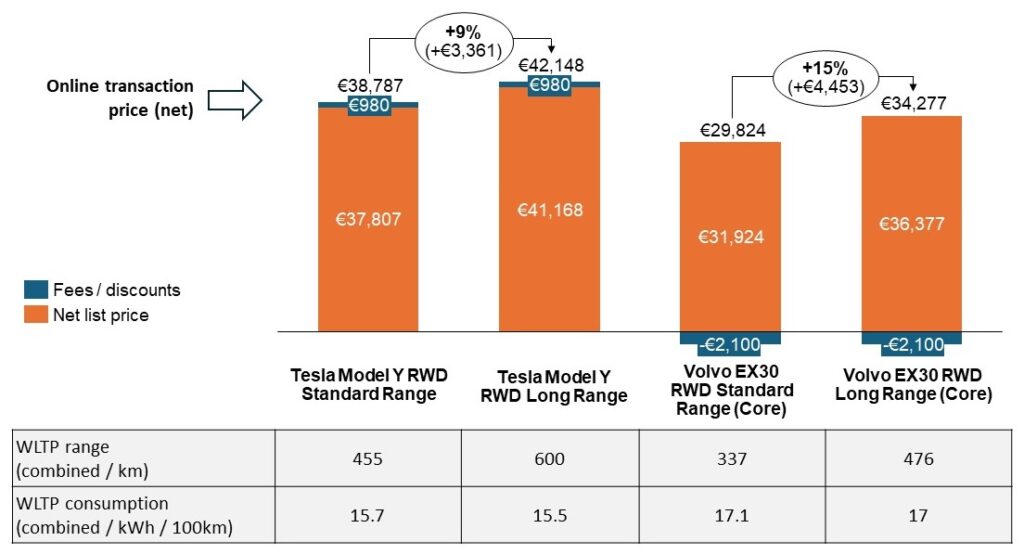

When comparing online transaction prices for new vehicles after fees and applicable company discounts, the initial challenge for bigger batteries is revealed. An additional range of approximately 140km costs between €3,400 and €4,500 (net). This price increase is smaller for Tesla than for Volvo, both in absolute and relative terms.

As a side note, the Model Y is attractively priced, and Volvo needs to offer an additional discount of €2,100 (net) to maintain the required distance between transaction prices. The larger Model Y also offers three times the boot volume of the EX30, while also being around 50cm longer and nearly 10cm taller and wider.

Transaction price difference by battery size for Tesla Model Y and Volvo EX30 in Germany

Note: € values are net (exclude VAT). Data from May 2024.

Surprisingly, the WLTP consumption figures do not differ much between each model’s battery variants. In fact, the long-range versions seem to operate more efficiently. Both carmakers use different battery technologies according to the intended range. Their smaller batteries use a lithium-iron-phosphate (LFP) chemistry, while the larger units use a lithium nickel manganese cobalt oxide (NMC) makeup. This is the primary contributing factor to the different battery efficiencies.

Small and economic?

So, how are battery sizes handled in leasing contracts of 36 months and 60,000km? Under its business leasing offer, Tesla charges a moderate €42 (net) per month for more range. This takes the range of the Model Y from an already considerable 455km (WLTP) to 600km (WLTP).

Across one year this accumulates to €504 of additional cost, and roughly €1,500 over three years. This is less than half of what would be paid if the vehicle was purchased outright.

Care by Volvo, the carmaker’s long-term rental and subscription service model, sits at a monthly premium of €59. This adds up to €708 a year and approximately €2,100 over three years. Under this plan, the EX30 goes from a lower range of 337km (WLPT) to a solid 476km (WLTP).

Despite these relatively small uplifts, the price still clearly points towards the smaller battery being the more economical choice. However, it is important to consider how usage impacts utilisation costs. When driving in higher-mileage scenarios, BEVs with a smaller range may require substantially more frequent public charging stops, which are more expensive and less convenient.

Testing with two scenarios

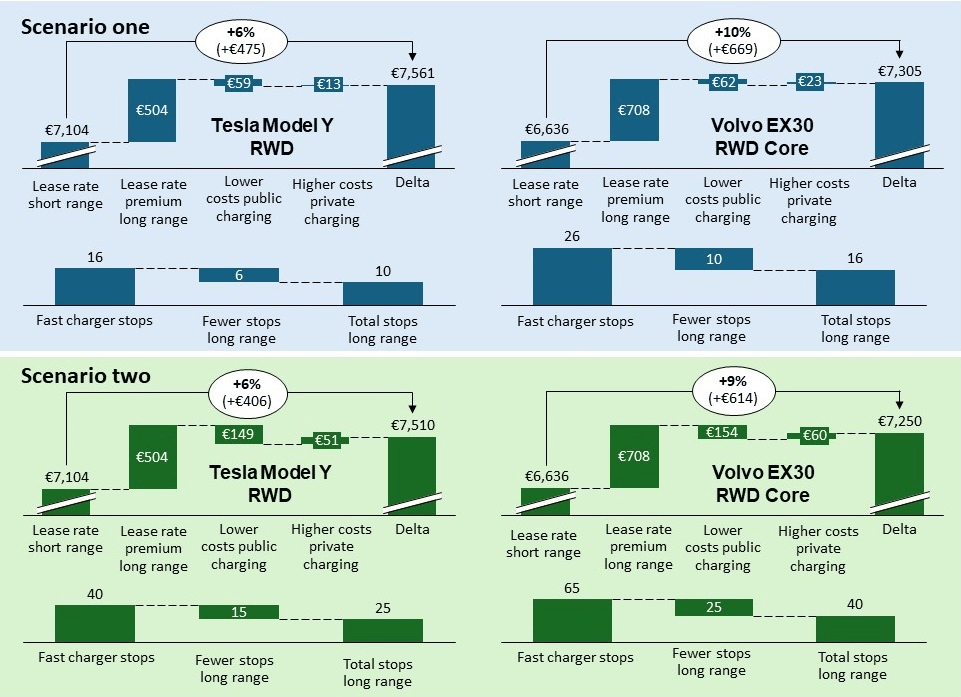

Two scenarios can be used to simulate these economic conditions, alongside certain assumptions.

In the first scenario, 80% of the annual 20,000km mileage covers short trips where all charging takes place at home or the workplace. Here, electricity costs are comparatively lower, at €0.25 per kWh (net) in Germany.

The remaining 20% of the annual mileage (4,000km) is made up of long-distance trips. This consists of four short weekend or business trips of 500km each and two larger journeys of 1,000km each.

It is assumed that the driver charges the vehicle to 100% ahead of each trip. Additionally, public charging points are only used when the remaining range reaches 40km, at which point the battery is recharged to 80%. This makes sense in terms of convenience, as it takes roughly the same time to charge from 20% to 80% as it does from 80% to 100%. The costs of fast charging at public infrastructure are set at €0.5 per kWh (net) in Germany.

For the sake of simplicity, real-life ranges are assumed to be 80% of the respective WLTP values for short distances and 65% for longer journeys, conducted at much faster speeds. These assumptions are in line with real-life consumption levels which have been observed, recorded and published in the public domain. Regardless, the overall results are not sensitive to these assumptions.

In the second scenario, the driving pattern is modified so that half of the mileage, 10,000km, is spent on longer trips. This equates to 10 weekend or business trips of 500km each and five longer journeys of 1,000km. The remaining assumptions are unchanged.

Smaller cost savings

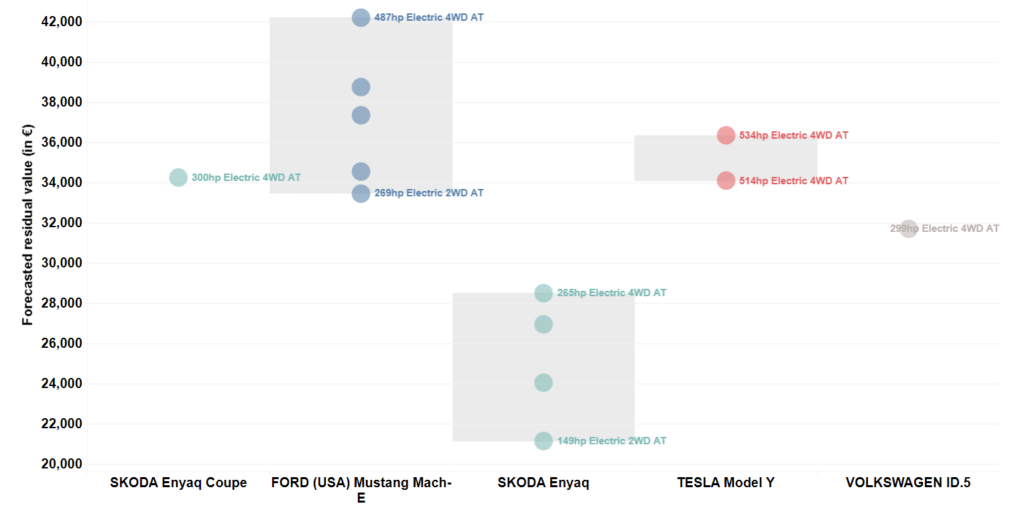

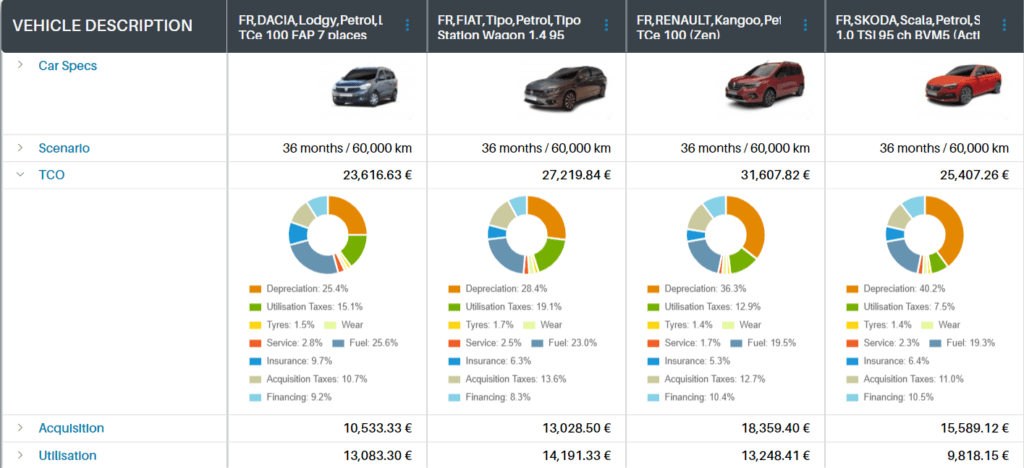

Under these scenarios, public-charging costs come down when switching from a short-range model to a long-range one. This is the case for both the Model Y and the EX30, however, the savings are not as significant as some might hope.

The annual cost savings accrued due to less public charging is only between €59 and €62 a year in scenario one and between €149 and €154 in scenario two. Savings partially erode as the car still needs to be charged, albeit at more affordable domestic or company wallboxes.

Annual cost difference when moving from a standard to a long-range BEV in Germany

Note: Leasing rates and charging costs are in € and net (exclude VAT). Vehicles are held for 36 months and the annual mileage is 20,000km. The starting point of ‘lease rate short range’ comes from manufacturer websites and represents the annualised monthly business rate. To balance this comparison, the Tesla Model Y has €111 added each month for insurance. This is because the carmaker does not include insurance in its offer, but Volvo does. Data is from May 2024.

Overall, with net cost savings, it is still more economical to opt for the smaller battery in both scenarios. This means the total cost of ownership (TCO) advantages remain for the smaller battery versions after simulating the more expensive stops at public chargers.

There is a noticeable difference between Tesla and Volvo. The annual TCO difference for the Model Y is only between €406 and €475 in both scenarios. This is because of the smaller premium required for the long-range model versus the standard-range version when compared to Volvo. For the EX30, the TCO difference is between €614 and €669 per year when choosing the larger battery over the standard one.

Calculating convenience

The added convenience of fewer public charging stops must also be considered for those BEVs with a bigger battery.

The standard Tesla Model Y offers such a good range it can handle the use case of scenario one quite well, requiring only 16 stops a year. Meanwhile, the long-range version reduces the annual number of stops from 16 to 10.

Here, the case for a smaller battery may be economically apparent, but for many people, the long-range version offers added flexibility at a small additional cost.

The longer-range variant of the Volvo EX30 reduces the number of stops more significantly from 26 to 16. Therefore, the added convenience of the longer-range version is considerable, but then so is the price premium. This makes it a tie in terms of choice, with budget and actual use case the likely deciding factors.

In scenario two, the standard-range Model Y makes 40 stops a year at public chargers. This will be enough to push most customers towards the long-range version. The TCO disadvantage of the bigger battery comes down to only €406 a year, or €27 per saved stop.

Similarly for the EX30, investing the additional €614 a year in scenario two would make sense. This would bring the stops down to 40 from 65 with the standard range version and costs €25 per saved stop.

A balanced decision

So, if the price or leasing rate increase for a larger battery is small, going big will mean an extra layer of convenience and security. This also reduces stress on developing infrastructure, with more stops requiring more chargers.

If the cost uplift is more substantial, smaller batteries will still deliver, while remaining the more economical choice. This is especially true if shorter trips define a person’s driving pattern.

However, when longer journeys underline a person’s driving pattern, it will be worth assessing the number of stops needed with the given battery variant. This will ensure a well-balanced decision between added costs, extra flexibility and greater convenience.

This content is brought to you by Autovista24.

Close

Close